If left to chance, report errors can drastically damage your creditworthiness. This easy guide explains how the dispute works with tips to file your own.

What is credit disputing?

Credit disputing is the act of sending a request to one, two, or all three credit bureaus to officially dispute a report error. The three major bureaus by name are Experian, TransUnion, and Equifax. The goal of disputing is to ideally remove any inaccurate information that may be negatively affecting your credit.

What items can I dispute?

In a nutshell, you can dispute any item on your credit report that contains an error or inaccuracy. There are many ways an error can show up on your report. Anything from a duplicate account to straight up fraud can be categorized as an error. For a more comprehensive list of the unique ways a credit report error can appear, click here.

Why is credit disputing important?

Errors can significantly damage your creditworthiness. Depending on the severity of the item, as well as what’s listed on your unique report, an inaccuracy could drop your score by 1 to 100 points or more. Yikes! Because of this, it’s important to monitor your Experian, TransUnion, and Equifax credit reports regularly. If an inaccuracy pops up on any of your reports, it’s critical to your credit that you take quick action to dispute it. Oh, and here’s the best part. Anytime you are able to remove an error that led to a derogatory mark on your report, you could experience a score boost!

How does the credit dispute process work?

In its most basic form, the credit dispute process can be broken down into the following three phases.

1. Check your credit report for errors

The first step in the credit dispute process is to check your credit report for errors. Look closely at each item listed to determine whether or not it’s accurate. And while checking your initial report is a great first start, unfortunately, it may not be enough. Here’s why. Your credit information can vary from one bureau to the next. This means that even if your initial report is solid, a damaging error could be lurking on the others. For this reason, it’s wise to review your reports with all three.

Review My 3-Bureau Credit Reports

2. File a credit dispute

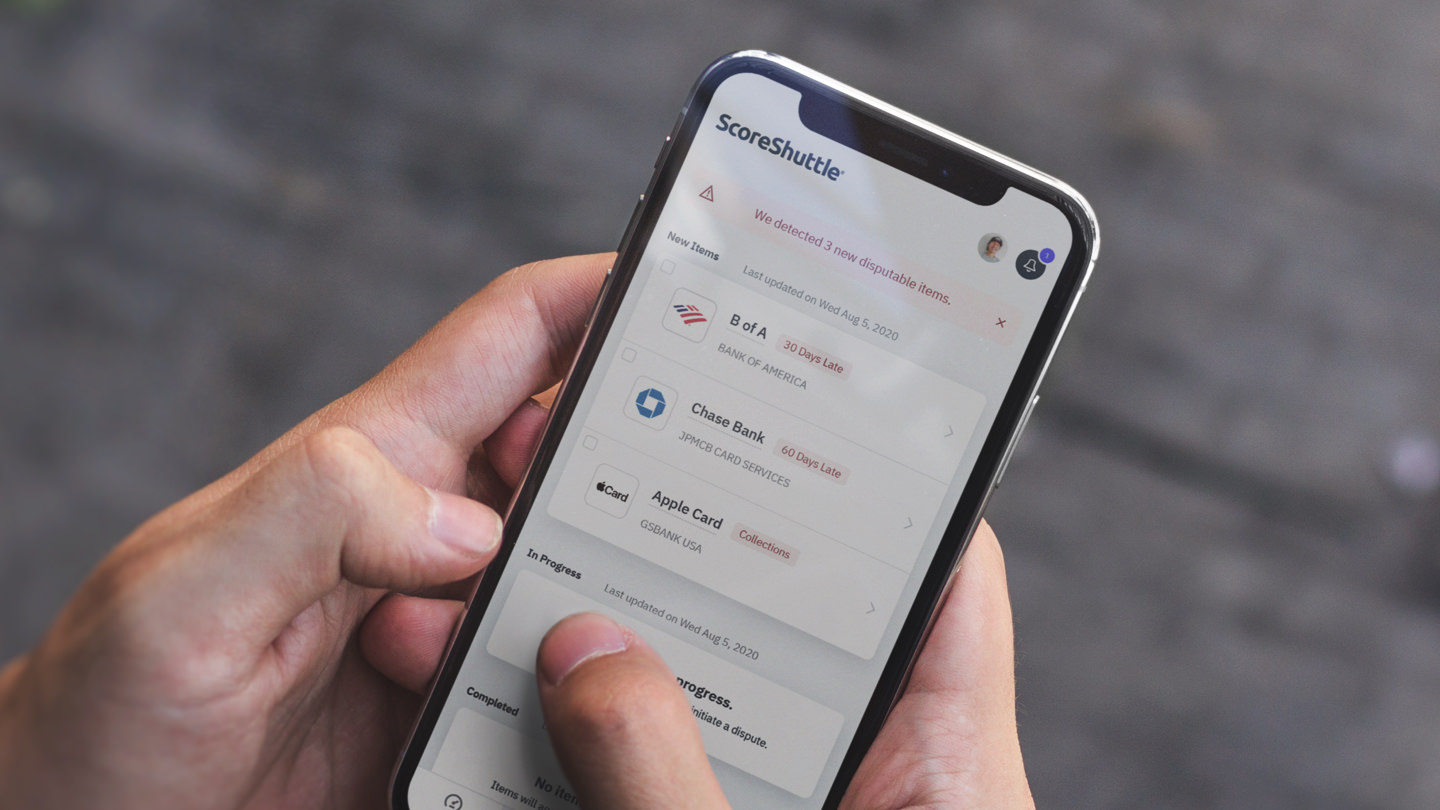

If you believe your credit report contains an error, your best shot at correction or removal is to file a credit dispute. This can be done either manually or digitally. If you chose to send a dispute manually, you will need to create a proper dispute letter, find the correct department it needs to get to, and mail it to any impacted credit bureau(s) directly. Alternatively, the fastest, easiest way to file a dispute is online. Automated tools, like those found in ScoreShuttle, allow you to file and track your disputes with Experian, TransUnion, and Equifax in just a few clicks.

3. Wait 30 to 45 days for your results

As amazing as overnight results would be, the credit dispute process requires a bit of a waiting period to complete. Once your dispute is received by the credit bureau(s), the bureau has at least 30 days to investigate your claim. Within this same time frame, the bureau(s) must then either respond or remove the item from your report. Depending on the source you use, it may take 30 to 45 days for the updated information to be shown on your credit report.

What can I do if a credit bureau denies my dispute?

If a credit bureau denies your initial dispute request, you have the option to issue a new one. You can continue this process until you receive optimal results. However, if the item is determined to be accurate, and you agree with its legitimacy, your options are fairly limited. For starters, you could write a goodwill letter to plead your case to the lender to see if they will remove the negative information from their end. Another option is to see if the lender or collection agency would be open to a payment in exchange for a deletion agreement. If they agree, it would allow you to potentially correct the damage by making good with your payments. Before you make any major money moves, make sure to get any deal you agree upon in writing. Although not a guarantee, a written agreement could give you leverage with the bureaus if the opposing party fails to uphold their part of the bargain. But regardless of the tactic, either the credit bureau or the lender who reported it will have the final say.

Bottom line

Credit inaccuracies can severely damage your creditworthiness. If you detect an error on your credit report, it’s important to dispute it fast! Credit disputing occurs in three basic phrases: reviewing your report for errors, filing a dispute, and waiting at least 30 to 45 days to see your results. Disputing may seem intimidating at first. But by following the easy steps above, you can simplify the dispute process and ideally achieve the most accurate credit results possible.

Disclaimer: The content provided is for informational purposes only and not to give advice or guidance on credit improvement. Dispute removal is determined by the credit bureaus and is not guaranteed. ScoreShuttle does not review, approve, or remove disputed items from credit reports.